Your Trusted Partner for Small Business Bookkeeping

Your Dedicated Financial Advocate for Business Success

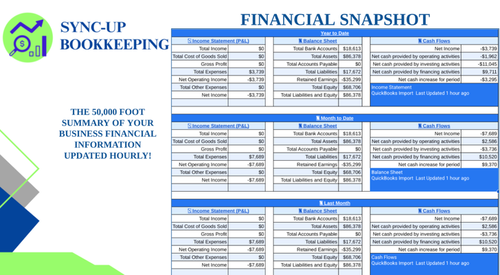

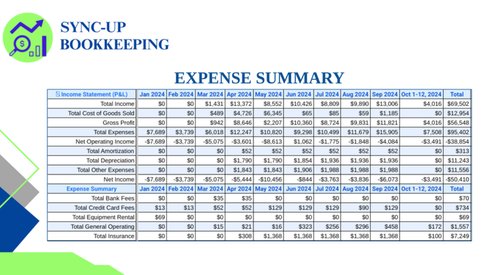

Managing your business finances shouldn’t be overwhelming. At Sync-Up Bookkeeping, we go beyond basic bookkeeping— we provide peace of mind and financial guidance. We act as your financial advocate, helping you streamline your financial processes, ensure tax compliance, and maximize profits so you can focus on what truly matters: growing your business.

Simplify Your Finances & Grow Your Business with Services that Matter

We help business owners reclaim time, improve financial clarity, and maximize profitability with expert bookkeeping services. Whether you need ongoing support, catch-up bookkeeping, or financial guidance, Sync-Up Bookkeeping is here for you.

Keep your finances in order, accurately & efficiently.

Behind on your books? We’ll get you up to date fast.

Track money in and out for better financial planning.

Stay compliant & ready with accurate records.

Streamline payroll and monitor business expenses.

Make informed, long-term financial decisions.

Sync-Up Bookkeeping is perfect for:

Who We Help

Small business owners who need financial clarity

Startups looking to manage expenses and plan growth

Professionals in law, healthcare, tech, construction, and more.

Entrepreneurs who want to focus on running their business

Why Choose Sync-Up Bookkeeping?

We’re not just bookkeepers—we’re your dedicated financial advocates. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

✔ 98% Client Satisfaction Rate – Our clients trust us to provide expert guidance and support.

✔ Save 40+ Hours Per Month - More time to focus on growing your business.

✔ $10,000+ in Missed Deductions Found - We ensure you keep more of your hard-earned money.

✔ Financial Clarity & Peace of Mind – Get the confidence to make strategic decisions with accurate, up-to-date financial reports.

Meet Your Dedicated Financial Advocates

We’re not just bookkeepers—we’re partners in your success. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

Andrew Clarke, CEO

From startups to Fortune 500s, Andrew's 45+ years of diverse experience across industries like aerospace, healthcare, and finance, uniquely equip him to simplify your business's bookkeeping and financial reporting. Andrew is passionate about making bookkeeping simple and stress-free. A nature-loving, fun, and business-savvy leader, Andrew ensures Sync-Up Bookkeeping is a trusted partner in financial success.

Sheri Clarke, COO

Sheri Clarke serves as COO of Sync-Up Bookkeeping, bringing over 30 years of experience in business operations and management to the role. Having a well-rounded perspective on the challenges businesses face, her experience uniquely positions her to help clients streamline processes and achieve success.

Ron Nocera, CMO

Ron Nocera serves as Sync-Up’s Chief Marketing Officer. Ron brings a strong background in process improvement and sales optimization to Sync-Up Bookkeeping. With a proven track record of driving efficiency and leading global teams, Ron is focused on developing and executing effective marketing strategies that support business growth.

Learn how Sync-Up Bookkeeping goes beyond the numbers.

Real Results from Real Clients

See how our Small Business Bookkeeping Services have helped businesses just like yours streamline their finances and achieve growth.

Insights & Expert Advice – Read Our Blog

Stay ahead of the curve with expert bookkeeping tips, financial strategies, and business growth insights. Our blog covers everything from tax-saving tips to financial planning best practices.

Your Financial Clarity Starts Today

Ready to take control of your finances and grow your business with confidence? Sync-Up Bookkeeping offers expert bookkeeping services, providing virtual support and financial insights tailored to your industry.

Book a Free 30-Minute Consultation and see how we can support your success.