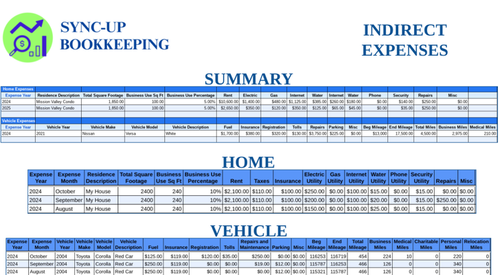

| ✪ Indirect Expense Summary (Sample) |

|---|

|

The Indirect Expense Summary report provides a consolidated view of a company's indirect expenses, which are costs associated with the business use of personal property. These expenses are not typically tracked directly within the accounting software but are essential for accurate financial reporting and tax purposes. The report summarizes expenses related to:

By analyzing the Indirect Expense Summary report, businesses can ensure they are accurately capturing and deducting these expenses, maximizing tax benefits and maintaining compliance with IRS regulations. |